Investment & market reports forstrategic business value.

Providing real-world, first-party data intelligence insights for non-technical executives and business leaders across the UK financial services sector.

OUR LATEST RESEARCH REPORT - Q1 2025

ISA 2025 Market Report

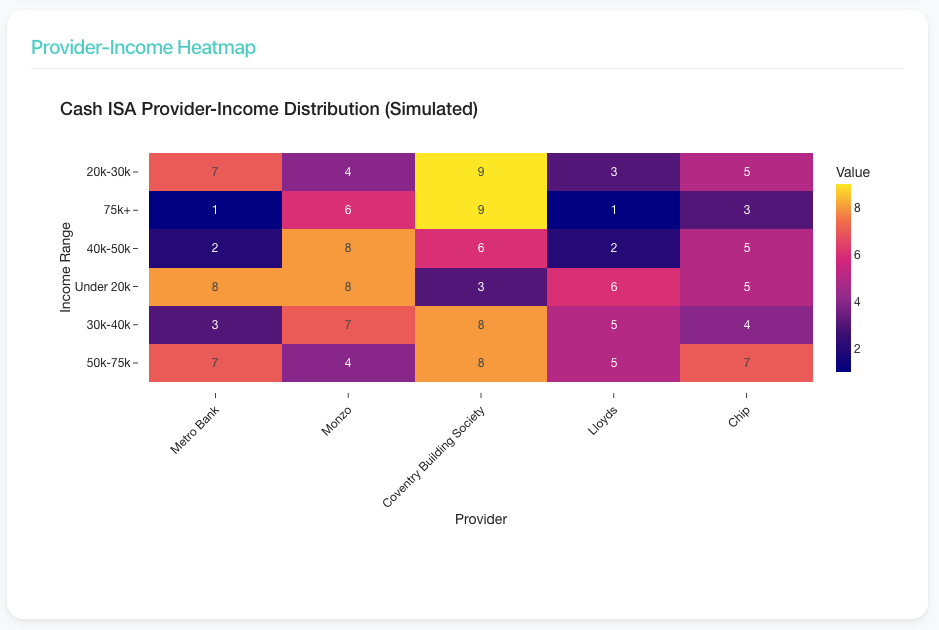

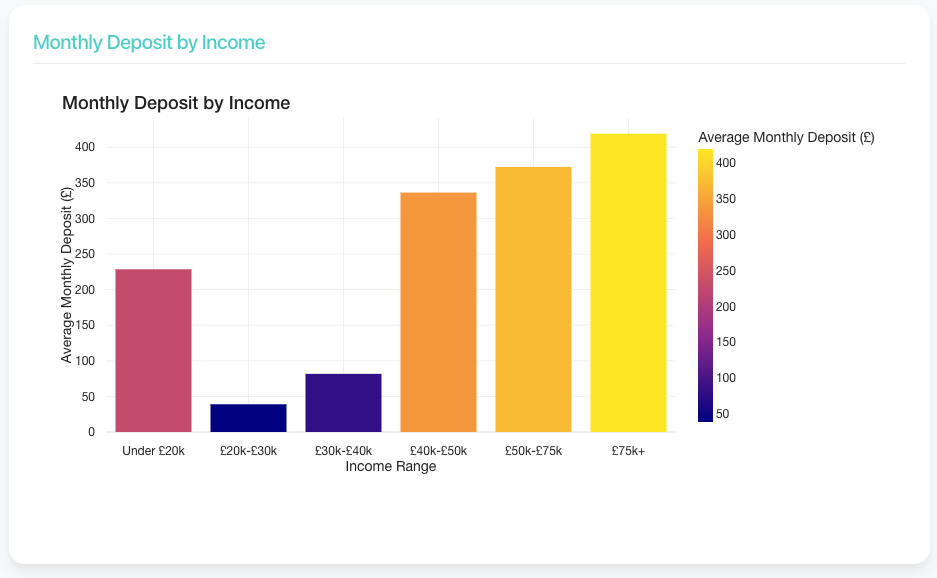

This in-depth analysis examines the Individual Savings Account (ISA) market landscape based on data collected on all UK ISA providers substantiated by anaononised and aggregated consumer insights. This report provides detailed segmentation by provider type, demographic distribution, deposit behaviour patterns, and interest rate competitiveness to deliver actionable intelligence on the current state of the ISA market in 2025.

- Demographic & behavioural data breakdown

- Provider / competitor analysis & comparison

- First-party insights & analysis

OUR REPORT PHILOSOPHY

Why TFE Reports Matter.

Behavioural data, demographic data, provider / competitor data & investment data from real UK investors across a wide range of demographics is an elusive beast but something we specialise in.

All of our data collection resources are completely impartial and are not associated with any one provider. This allows us to collect completely honest and impartial data from a variety of demographics and audience-types.

Not only do we provide detailed breakdowns by age, income, deposit amounts and demographic data but we also compare these factors across provider choice and more for comprehensive insights.

Premium Resources

Subscribe to our monthly membership to receive our quarterly ISA & Pension reports as well as monthly trading & investment insights.

API Access

Work with us directly to access real-time data via API for integration into your internal systems or for detailed AI reports .

EXPLORE OUR OTHER REPORTS

Our Previous Reports

Trading 2025 Report

Explore retail trader sentiment & trends across stocks, forex and investments based on real retail trading behaviours – understanding how lot size & risk behaviours, instrument choice, experience level converge and intersect.

ISA 2025 Market Report

Explore key 2025 ISA behaviours across demographics as diverse as 18+ to 55+ and how investment trends expanded or contracted amongst providers.

Pension 2025 Report

- Explore how pension and annuities evolved over 2025. Access trends, insights and key annuity provider reports on the leading UK pension sector.

FEATURES & RELEASES

What's Included in Every Report?

We release quarterly reports for our Pensions & ISA’s data and monthly reports for our trading & investment data. The quarterly reports allow for a deeper data collection analysis in slower moving financial services sectors and monthly reports for faster moving investment and trading sectors allow for reflections on real investor trends and sentiment data.

For real-time access to trading insights for sentiment shifts, trending instruments and positioning, please get in touch.

For every quarterly report, you will get access to the following information:

- Comprehensive segmentation data based on age, income, provider.

- Anomalous / outlier data for potential trends & forecasting.

- Competitor / provider data for ISAs, Pensions & Investments.

- Marketing & sales insights into demographic targeting.

- Insight into potential trend drivers & macro-trends based on data.

Data Intelligence for Strategy Insights.

Access our latest reports for the latest in quarterly or monthly insights based on real first-party data.

Licensing

Licensing options

Single User License

Single user license to existing & upcoming reports. Receive our latest quarterly PDF reports when released across all verticals.

£1,299 p/m

/ Month

- Money back guarantee (30-days & unused license)

- Acess to one report for one user

- Access will be given to one email address

Enterprise License

Access existing & upcoming reports for your organisation – anyone with the same @email.com address.

£2,999 p/m

(Save 20%)

Everything in the Single User License, plus:

- Access for multiple teams using the same email.

- Priority support

Testimonials

What they say about us

- 5.0

Young Alaska, London

- 4.5

Lucas Tomhill, Bangkok

- 5.0

Frederic Simon, New York

- 5.0

Young Alaska, London

- 4.5

Lucas Tomhill, Bangkok

- 4.5

Frederic Simon, New York

Q3 Investment & Trading Report

Get access to over 500+ real trader reports with detailed breakdowns on instrument selection, experience level, stop loss and take profit / risk-reward metrics and broker selections for insight into retail trading behaviours in Q3 2025.

- Real trading data from traders across the UK

- All major broker data for insight into demographic and experience levels for each